EXCLUSIVE This may be the death knell for the Friars Club.

The historic, legendary organization that once boasted members like Joan Rivers, Billy Crystal, Alan King, and so on has had a devastating turn of events. The IRS has stripped the club of its tax exempt status. The reason? The club had not filed a Form 990 tax return in over three years.

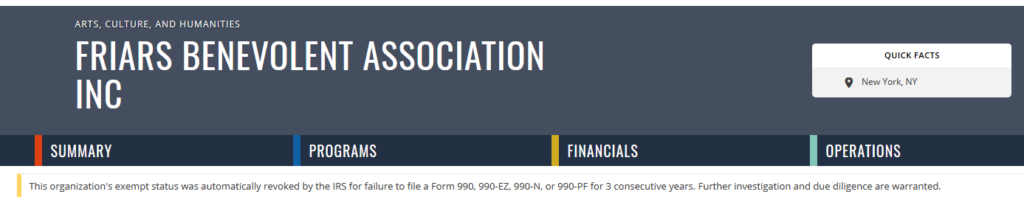

The news is posted to GuideStar, which monitors tax exempt organizations. The last time the Friars filed was in 2015.

At that time I was already reporting their nosedive into disaster. In the last six months, the Club finally fired its president, Michael Gyure, who’d been found guilty of personal tax evasion. Right before that they suffered a massive flood in their historic building on East 55th St., which shut them down. They’d already endured losing a sexual harassment suit brought their former receptionist. And the Feds had previously raided the premises to see what Gyure had been doing.

Just last month the whole staff was dismissed. Sources say the club did get insurance money from the flood. They may also have qualified for government assistance thanks to the virus.

But without the 501 c(3) designation, the Friars are lost. On their Guidestar title page, you can find just this: “This organization’s exempt status was automatically revoked by the IRS for failure to file a Form 990, 990-EZ, 990-N, or 990-PF for 3 consecutive years. Further investigation and due diligence are warranted.” They’ve also been removed from Charity Navigator.

It’s unclear who knows the Friars can no longer collect money as a charity or foundation. They’d announced a Friars Roast of Al Sharpton, but that won’t he happening, nor will any more roasts. If anyone knows more, you can always email me at showbiz411@gmail.com